Indicators on zero down chapter bankruptcy You Should Know

As mentioned just before, hiring an attorney could be valuable, nevertheless it’s not legally required. In actual fact, Lots of individuals file bankruptcy efficiently without having one particular each day. The Bankruptcy Code, which lays out bankruptcy guidelines, enables you to file your circumstance by yourself.

This unique solution lets people today with confined fiscal methods to file for bankruptcy without having an upfront payment to their attorney.

Your credit score rating has enhanced ample to make you a decreased curiosity charge than that of one's present-day debts.

Also, once you file for Chapter 7, A lot of the residence you very own – aside from your exemptions – will come under the control of the bankruptcy court docket. You won't manage to offer or give absent any of that property with no consent of your courtroom. On the summary with the Chapter 7 process, your debts will likely be discharged through the court, except for non-dischargeable debts for example baby guidance, tax debts, and student loans.

Chapter nine. This is yet another repayment approach that allows cities, metropolitan areas, and other federal government entities a chance to reorganize and shell out back their debts.

When thinking about bankruptcy as a potential Answer to mind-boggling financial debt, It can be very important to be familiar with which debts qualify for this method. Whilst bankruptcy can handle a variety of forms of debt, not all money obligations are suitable. Let's check out the prevalent qualifying debts for bankruptcy.

The skilled Stafford bankruptcy attorneys at Fisher-Sandler provide over sixty a long time of merged bankruptcy counsel and illustration to individuals and smaller business people who can now not deal with the load of their debts.

By clicking “Post”, you agree the telephone number and email deal with that you are furnishing could possibly be utilized to Make contact with you by Countrywide Personal debt Relief (together with vehicle-dialed/car-picked and prerecorded calls, and also text/SMS messages).

You'll need to Stay in just this spending plan for nearly 5 a long time. In the course of that time the courtroom will continually Examine your shelling out, and may penalize you severely for those who aren't next the prepare. Seem like enjoyable? To major it off, it will eventually remain with go to the website your history for seven yrs.

Even though it's very good to acquire the option to declare bankruptcy, it's not difficult to see why it must generally be the final alternative. Declaring bankruptcy is often a drastic action to choose, and may impact your daily life for years to return.

The intent behind this analysis is in order that All those with limited monetary resources have access to the benefits of Chapter seven bankruptcy, which permits the discharge of unsecured debts devoid of repayment options.

These providers function closely along with you to style personalized debt repayment techniques, go to this web-site negotiate lessen fascination costs on your own behalf, and examine authorized options for monetary respite.

Absolutely sure! You can consider finding a standard financial loan from a financial institution or credit rating union, borrow dollars from mates or family members to pay back debts, or work on your aspect hustle to generate check it out more dollars to pay for down That which you owe.

Upsolve is fortunate to possess a impressive workforce of bankruptcy Lawyers, as well as finance and purchaser rights professionals, as contributing writers to help you us preserve our content updated, instructive, and valuable to everyone.

Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Jaclyn Smith Then & Now!

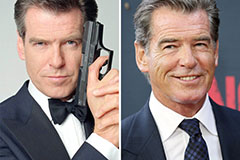

Jaclyn Smith Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!